sales tax in austin texas 2021

Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. December 1 2021.

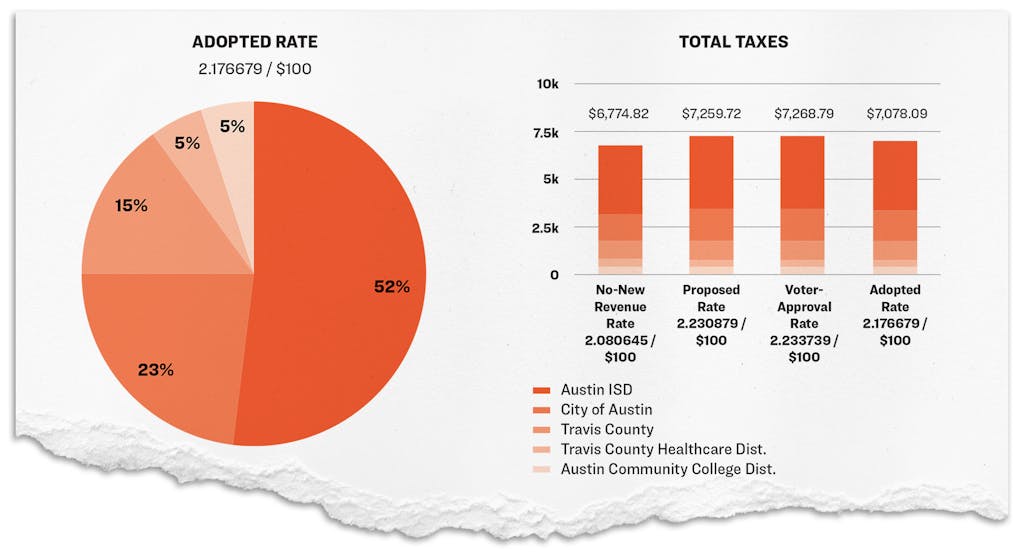

Property Tax Calculator Estimator For Real Estate And Homes

The City receives 107143 of total mixed beverage tax receipts collected in.

. State Sales Tax Revenue Totaled 36 Billion in November AUSTIN Texas Comptroller Glenn Hegar today said state sales tax revenue totaled 356. The Austin Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Austin local sales taxesThe local sales tax consists of a 100 city sales tax and a 100 special. Local taxing jurisdictions cities counties special.

The County sales tax rate is. The Texas sales tax rate is currently. The Economic Development Sales Tax Workshop.

Texas has a 625 statewide sales tax rate but also has 989 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 169 on. Hegar noted that clothing stores seem to be rebounding strongly after a tough year. Online registration is now closed.

The minimum combined 2022 sales tax rate for Austin County Texas is. The minimum combined 2022 sales tax rate for Austin Texas is. The State of Texas assesses a 67 gross receipts tax and an 825 sales tax on mixed beverages.

The 825 sales tax rate in Austin consists of 625 Texas state sales tax 100 Austin tax and 100 Special tax. This is the total of state and county sales tax rates. The base state sales tax rate in Texas is 625.

Arlington TX Sales Tax Rate. There is no applicable. There is no applicable county.

Find your Texas combined state and. Austin TX Sales Tax Rate. Texas Sales Tax.

What is the sales tax rate in Austin TX. The Texas state sales tax rate is currently. Austin collects the maximum legal local sales tax.

While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied. The 825 sales tax rate in Austin consists of 625 Texas state sales tax 1 Austin tax and 1 Special tax. Total sales tax revenue for the three months ending in April 2021 was up 45 compared.

This is the total of state county and city sales tax rates. Local tax rates in Texas range from 0125 to 2 making the sales tax range in Texas 6375 to 825.

Texas Sales Tax Guide For Businesses

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Housing Market Austin Chamber Of Commerce

Letters To The Editor Texas Needs An Income Tax

How To File A Sales Tax Return Electronically As A List Filer Official Youtube

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Will Real Estate Ever Be Normal Again The New York Times

Texas Sales Tax Guide For Businesses

Texas Sales Tax Revenue Reaches 3 69 Billion In May Up 8 6 From May 2021 Texas Thecentersquare Com

Top 6 Reasons Why Californians Are Moving To Austin Tx

Sales Tax Revenue Increases In Central Texas Suburbs Shrinks In Austin Kvue Com

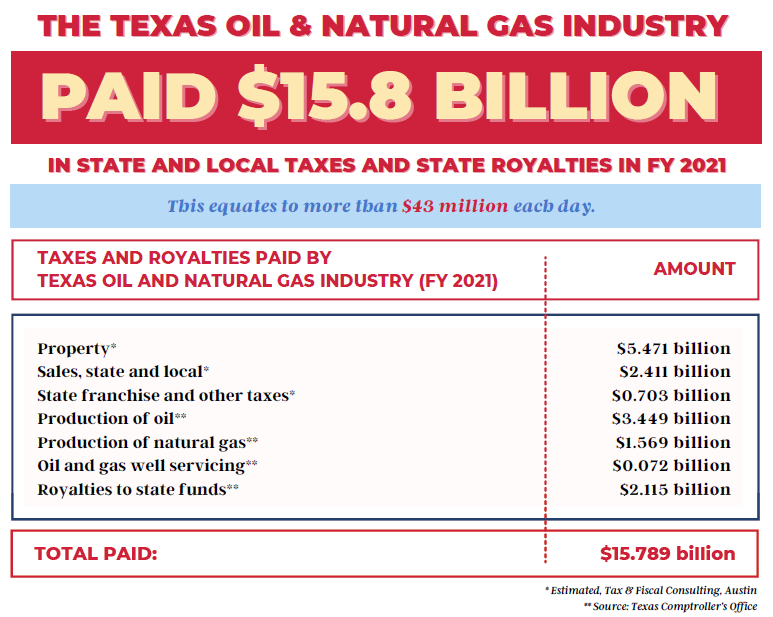

Texas Oil And Natural Gas Industry Paid 15 8 Billion In Taxes And State Royalties In Fiscal Year 2021 Texas Oil Gas Association

Texas Sales Tax In A Nutshell Quaderno

Texas Is At Odds With Itself Over Sales Tax Wacky Tax Wednesday

Texas Sales Tax Holiday August 6 8 Save On Clothes School Supplies

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

Texas Sales Tax Small Business Guide Truic

/cloudfront-us-east-1.images.arcpublishing.com/dmn/QDGNW75DHNCHDKSNOXPQADTRX4.jpg)

Texas Has A 27 Billion Surplus Should It Cut Taxes Or Invest In Infrastructure